16 Dec Planning 2016 Taxes: New Income Levels for Tax Brackets

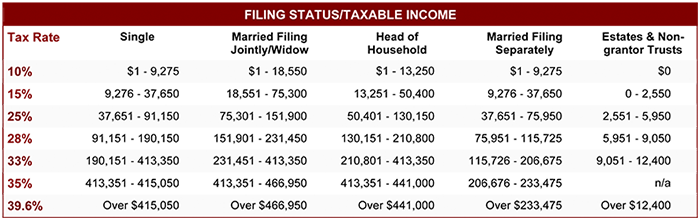

Here is a quick look at 2016 tax rates and their associated income levels. Using your past tax information, you can plan for your tax obligation next year starting now.

Don’t forget that tax payers in the higher income levels are also subject to an additional .9% Medicare Tax introduced to help pay for the Affordable Care Act. This will impact those with incomes over:

- $200,000 Single filing

- $250,000 Married filing joint

2016 TAX RATES & RELATED INCOME LEVELS

Action Steps

- Review your Adjusted Gross Income and use the chart above to determine your marginal tax rate. This is the income tax rate applied to the last dollar you earned.

- Note whether your next dollar of income will be taxed at a higher rate. The closer you are to the next highest tax rate could identify an opportunity for tax planning.

- If you need to withhold additional money to avoid a large tax bill, review and file a new W-4 with your employer.

- If possible, take steps now to manage next year’s tax obligation. The sooner you get started, the more options you will have.