09 Jun 2018 Health Savings Account Limits Time to plan your 2018 deductions

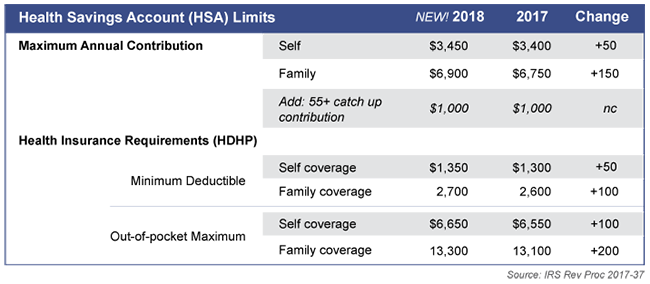

The savings limits for the ever-popular Health Savings Accounts (HSA) are now set for 2018. The new limits are outlined here with current year amounts noted for comparison purposes.

What is an HSA?

An HSA is a tax-advantaged savings account to pay for qualified health care costs for you, your spouse, and your dependents. When contributions are made through an employer, they are made on a pre-tax basis. There is no tax on the withdrawn funds, the interest earned, or investment gains as long as the funds are used to pay for qualified medical, dental, and vision expenses. Unused funds may be carried over from one year to the next. To qualify for this tax-advantaged account you must be enrolled in a high deductiblehealth plan (HDHP)as defined by HSA rules.

The limits

Note: To qualify for an HSA you must have a qualified High Deductible Health Plan (HDHP). A plan must meet minimum deductible requirements that are typically higher than traditional health insurance. In addition, your coverage must have reasonable out-of-pocket payment limits as set by the above noted maximums.

Not sure what an HSA is all about? Check with your employer. If they offer this option in their health care benefits, they will have information discussing the program and its potential benefits.