31 Oct IRS Releases Key 2018 Tax Information

The IRS recently announced key figures for 2018, using figures based on the Consumer Price Index published by the Department of Labor. Use these early figures to start developing your tax strategies for next year.

Tax Brackets: There are currently seven tax brackets ranging from 0 percent to 39.6 percent. Each of the income brackets rose between 1.9 and 2.1 percent.

Personal Exemption: $4,150 in 2018 (up $100 from 2017)

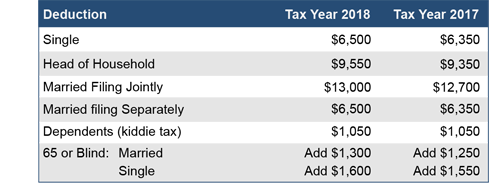

Standard Deductions:

Other Key figures:

Caution: Remember, these early IRS figures are prior to any potential tax law changes currently under consideration in Washington D.C.