25 Apr Audit Rates Decline for Sixth Year in a Row. But don’t get complacent…

The IRS reported audit rates declined last year for the sixth year in a row and reached their lowest level since 2002. That’s good news for people who don’t like to be audited (which is everybody)!

But don’t get complacent. A closer look at the IRS data release reveals some audit pitfalls you should know about. Here is what you need to know:

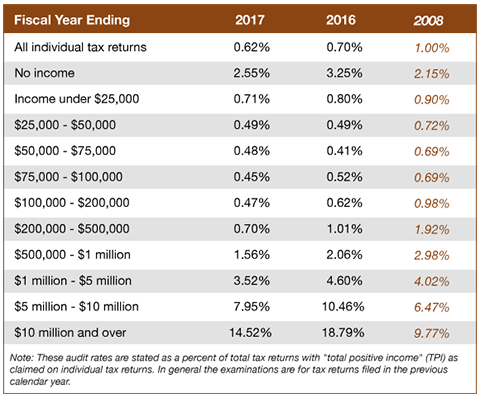

Audit Rate Statistics for Individuals

Observations

- Low statistics for audit examinations obscure the reality that you may still have to deal with issues caught by the IRS’s automated computer systems. The most common are math or typo errors and missing forms. These could be enough to trigger a correspondence audit, which is done through the mail. While not as daunting as a full audit, you’ll need to keep your records handy to address any problems.

- Average rates are declining, but audit chances are still high on both ends of the income spectrum: no-income and high-income taxpayers.

- No-income taxpayers are targets for audits because the IRS is cracking down on fraud in refundable credits designed to help those with low income, such as the Earned Income Tax Credit (EITC). The EITC can refund back more than a low-income taxpayer paid in, so scammers attempt to collect these refund credits through fraudulent returns.

- High-income taxpayers have increasingly been a target for IRS audits. Not only do wealthy taxpayers tend to have more complicated tax returns, but the vast majority of federal income tax revenue comes from wealthy taxpayers. Based on the statistics, the very highest income taxpayers can assume they will be audited about every six years.

- Complicated returns are more likely to be audited. Returns with large charitable deductions, withdrawals from retirement accounts or education savings plans, and small business expenses and deductions (using Schedule C) are more likely to be the subject of an audit.

Stay Prepared

Though audit rates are declining, don’t discount the possibility that you may still be selected randomly for an audit. Always retain your tax records and support documents for as long as you need them to substantiate claims on a return. The IRS normally has a window of three years from the filing date to audit a return, but this can be extended if the agency believes there’s any fraudulent activity going on.

If you do receive an audit letter from the IRS, it’s best to reach out for some professional assistance as soon as possible.