22 May Chances of Audit Continue to Drop What you need to know

You can be audited the later date of either three years after the filing deadline of your tax return or when you actually filed your tax return. However, there are two main exceptions to this rule that can extend the risk of being audited;

- If the IRS audits a tax return and discovers an error of more than 25% of your claimed tax obligation they can go back six years.

- If the IRS deems there is fraud involved, they can go back indefinitely.

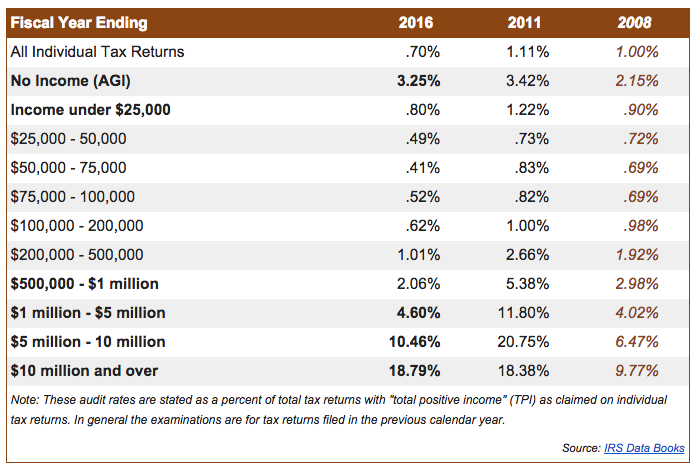

Every year the IRS publishes their examination statistics. Provided here are three years of published information to help you identify trends:

Audit Rate Statistics for INDIVIDUALS

Observations

- Despite complaints of fewer audits from the IRS, the audit rates are still up dramatically versus 2008 for those with incomes over $500,000. This is because the vast majority of income tax collected comes from these taxpayers.

- Upper income taxpayers could assume they will be audited every 3 to 5 years.

- Note the large drop in audit rates in the $1 million to $10 million range versus 2011. While still high versus the 2008 rates, it is halved from 2011 audit rates.

- Those with incomes over $10 million have seen their audit rate double since 2008.

Note that the IRS is also auditing taxpayers with little to no taxable income. Much of this is due to the high incidence of error and fraud within the Earned Income Tax Credit.

Play it safe

Always retain your tax records and support documents for as long as they may be needed to substantiate claims on your tax return. Make sure you consider any state record retention requirements as you review when it is safe to destroy old records. Remember some records need to be retained indefinitely. This includes, at minimum, copies of original tax returns, legal documents, and real estate transactions.